All Categories

Featured

Table of Contents

You can waste a great deal of time and cash making use of information that is wrong or outdated. People look software program will certainly give better data for your business. Examination BellesLink data for yourself. When you wish to browse a listing of people, Batch Search is the tool to utilize due to the fact that you can can search hundreds of records simultaneously and returned detailed search results page with current telephone number, addresses, and e-mails.

Conserve time by looking thousands of records at one time, rather of private searches. When you need to do a total search to find contact details for a specific, their loved ones, neighbors and partners, you'll want to utilize people searches.

Data from your people searches can be saved right into a contact record. Get in touches with can be taken into teams, arranged with tags, and expanded with customized areas. Make telephone call, send messages, and save notes from the contacts you create. In all the speak about data and searches, it's very easy to forget why services utilize people search devices in the very first area, the reason is to reach the individual by phone, text, and email.

Finding Properties That Owe Back Taxes

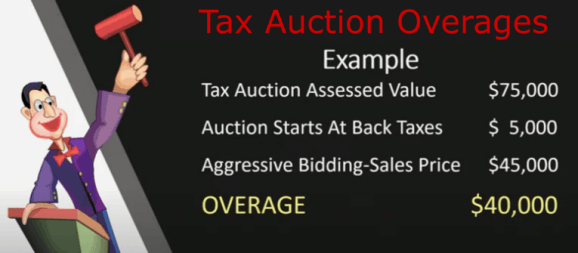

Every so often, I hear speak about a "secret brand-new possibility" in business of (a.k.a, "excess profits," "overbids," "tax obligation sale surpluses," etc). If you're completely not familiar with this principle, I would certainly like to offer you a fast summary of what's going on right here. When a building proprietor stops paying their real estate tax, the neighborhood community (i.e., the region) will certainly wait for a time prior to they confiscate the residential or commercial property in repossession and market it at their annual tax obligation sale public auction.

The information in this write-up can be influenced by several unique variables. Expect you possess a residential property worth $100,000.

Tax Land Sales

At the time of repossession, you owe about to the region. A couple of months later, the area brings this home to their yearly tax sale. Here, they market your residential or commercial property (together with dozens of various other overdue buildings) to the highest bidderall to recover their lost tax obligation profits on each parcel.

This is because it's the minimum they will need to recoup the cash that you owed them. Below's things: Your building is easily worth $100,000. Many of the financiers bidding on your property are fully aware of this, as well. Oftentimes, residential properties like yours will certainly get proposals much past the quantity of back tax obligations in fact owed.

Buying Back Tax Properties

However obtain this: the region only needed $18,000 out of this residential or commercial property. The margin between the $18,000 they required and the $40,000 they obtained is understood as "excess proceeds" (i.e., "tax obligation sales overage," "overbid," "surplus," etc). Many states have statutes that prohibit the region from keeping the excess settlement for these properties.

The region has guidelines in area where these excess profits can be claimed by their rightful owner, typically for a marked period (which varies from state to state). If you lost your home to tax repossession because you owed taxesand if that home consequently offered at the tax sale auction for over this amountyou can probably go and accumulate the distinction.

This consists of confirming you were the prior proprietor, completing some documents, and waiting on the funds to be provided. For the average individual that paid complete market price for their residential property, this strategy doesn't make much sense. If you have a major quantity of money spent right into a home, there's way also a lot on the line to simply "let it go" on the off-chance that you can milk some additional squander of it.

With the investing technique I utilize, I could purchase residential or commercial properties free and clear for pennies on the dollar. To the shock of some investors, these offers are Assuming you understand where to look, it's honestly uncomplicated to discover them. When you can purchase a residential or commercial property for a ridiculously inexpensive cost AND you recognize it's worth substantially greater than you spent for it, it may extremely well make sense for you to "roll the dice" and attempt to collect the excess profits that the tax obligation foreclosure and public auction procedure produce.

While it can absolutely turn out comparable to the way I have actually described it above, there are likewise a couple of downsides to the excess profits approach you actually should understand - back taxes owed on foreclosed property. While it depends substantially on the characteristics of the property, it is (and in many cases, most likely) that there will be no excess profits generated at the tax obligation sale public auction

Excess Proceeds Texas

Or maybe the county does not generate much public passion in their auctions. Either way, if you're getting a residential property with the of letting it go to tax repossession so you can collect your excess proceeds, what if that cash never comes with?

The very first time I pursued this technique in my home state, I was informed that I didn't have the choice of claiming the surplus funds that were generated from the sale of my propertybecause my state didn't enable it. In states such as this, when they create a tax sale overage at a public auction, They just keep it! If you're thinking regarding utilizing this technique in your company, you'll intend to assume lengthy and tough regarding where you're doing organization and whether their legislations and laws will also permit you to do it.

Houses For Sale For Delinquent Taxes

I did my best to provide the right response for each state above, however I would certainly advise that you before waging the presumption that I'm 100% correct. Keep in mind, I am not a lawyer or a certified public accountant and I am not attempting to hand out expert lawful or tax obligation recommendations. Talk with your lawyer or certified public accountant before you act on this details.

The truth is, there are hundreds of public auctions all over the nation yearly. At much of these public auctions, hundreds (or also thousands) of capitalists will certainly show up, get into a bidding war over a lot of the homes, and drive costs WAY more than they must be. This is partially why I've never ever been a substantial fan of tax obligation sale auctions.

Check its precision with a third-party expert before you start). Get a overdue tax list. There are a few methods to do this (one more of which is described right here). Send out a direct-mail advertising project (ideally, a few months from the repossession day, when encouraged vendors are to dump their home for next-to-nothing costs).

Play the waiting game until the residential property has been confiscated by the county and offered and the tax sale.

Going after excess profits supplies some pros and disadvantages as a business. Think about these before you add this approach to your property spending arsenal. This strategy needs minimal effort on the selling side. If selling is something you definitely dislike, this might affect your choice. There can be some HUGE upside possible if and when the stars straighten in your favorthey seriously need to in order to achieve the most effective possible result.

Tax Foreclosures Homes For Sale

There is the possibility that you will make nothing in the long run. You might shed not just your money (which ideally will not be significantly), but you'll likewise shed your time as well (which, in my mind, deserves a whole lot extra). Waiting to gather on tax obligation sale excess requires a lot of sitting, waiting, and expecting results that generally have a 50/50 possibility (generally) of panning out positively.

If this seems like a company chance you wish to dive into (or at least find out more regarding), I recognize of one person that has actually created a full-blown course around this specific type of system. His name is and he has actually discovered this realm in great detail. I have actually been through a number of his programs in the past and have discovered his approaches to be highly reliable and reputable money-making methods that work extremely well.

A Tax Obligation Sale Overages Company is the perfect business to lack your home. If you are trying to find a way to supplement your income, which can at some point become a permanent profession, then this could be for you. All you truly need to get going is an Office with the following things: Computer with Net Connection Printer Cellular Phone Miscellaneous Workplace SuppliesThis book will certainly walk you via the process of starting and running this kind of business, step-by-step, in addition to, to talk about the most effective ways to tackle getting these Tax obligation Sale Overages for your customers while making money for your efforts.

Table of Contents

Latest Posts

Tax Lien Investment Bible

Tax Lien Investment

Tax Ease Lien Investments Llc

More

Latest Posts

Tax Lien Investment Bible

Tax Lien Investment

Tax Ease Lien Investments Llc