All Categories

Featured

Table of Contents

The requirements likewise advertise innovation and development with additional financial investment. Regardless of being recognized, all capitalists still require to perform their due persistance throughout the procedure of investing. 1031 Crowdfunding is a leading property financial investment platform for alternative financial investment vehicles mainly available to accredited capitalists. Recognized investors can access our option of vetted financial investment possibilities.

With over $1.1 billion in protections offered, the administration group at 1031 Crowdfunding has experience with a wide variety of financial investment frameworks. To access our total offerings, register for a financier account.

Accredited's workplace society has frequently been Our team believe in leaning in to sustain enhancing the lives of our associates similarly we ask each various other to lean in to passionately support boosting the lives of our customers and neighborhood. We provide by supplying methods for our group to rest and re-energize.

Value Real Estate Crowdfunding Accredited Investors Near Me (Indianapolis)

We likewise use up to Our perfectly assigned structure includes a health and fitness area, Relax & Leisure areas, and innovation designed to sustain flexible offices. Our finest concepts originate from collaborating with each various other, whether in the workplace or functioning remotely. Our positive investments in modern technology have enabled us to create an allowing personnel to contribute any place they are.

If you have an interest and feel you would be an excellent fit, we would certainly like to link. Please make inquiries at.

Comprehensive Accredited Investor Income Opportunities Near Me – Indianapolis IN

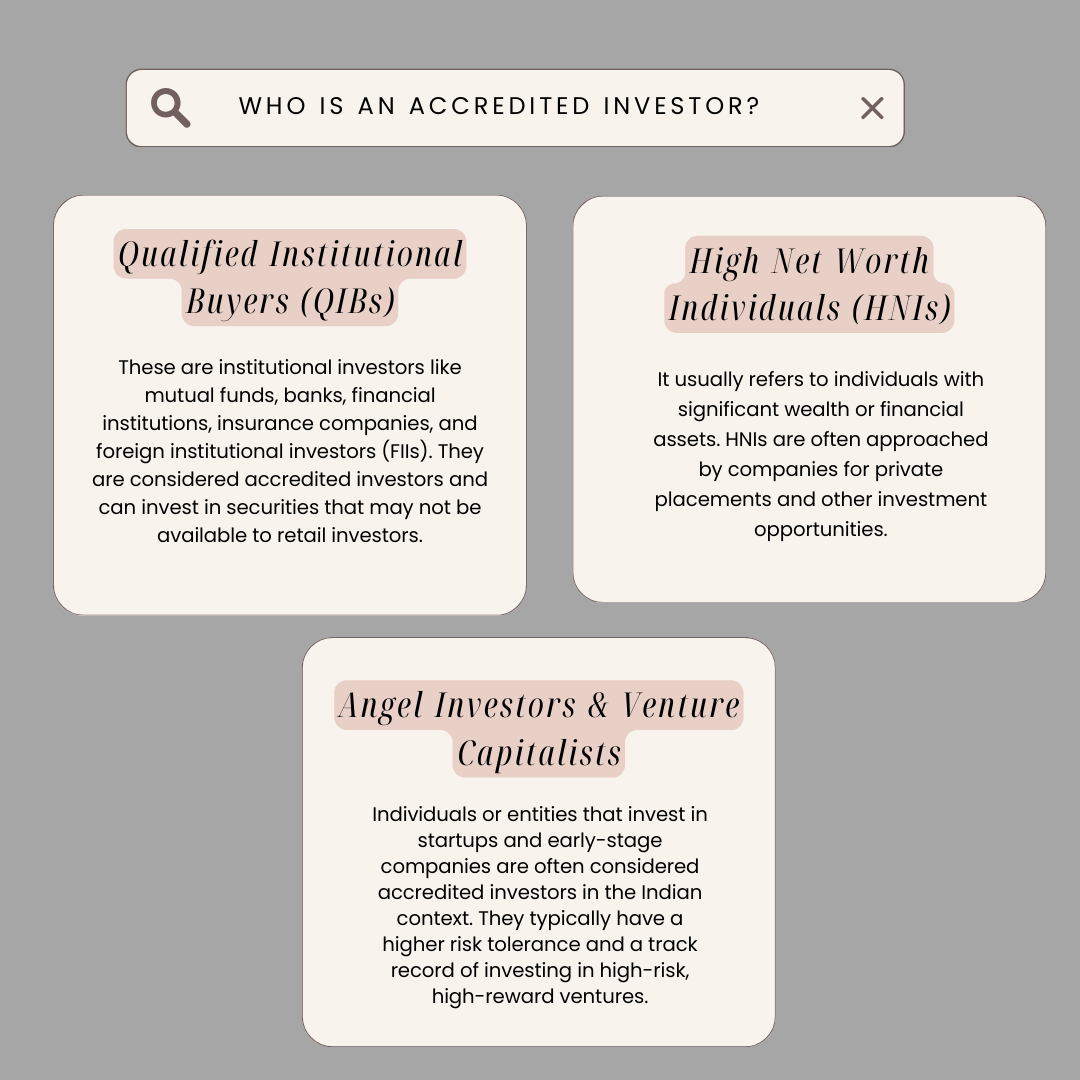

Accredited investors (sometimes called qualified financiers) have access to financial investments that aren't offered to the basic public. These financial investments might be hedge funds, tough money loans, convertible financial investments, or any type of various other safety that isn't signed up with the monetary authorities. In this article, we're going to focus particularly on realty financial investment alternatives for certified financiers.

This is everything you require to understand about realty investing for certified investors (accredited property investment). While any individual can buy well-regulated safety and securities like supplies, bonds, treasury notes, mutual funds, and so on, the SEC is worried about average investors getting involved in financial investments beyond their methods or understanding. Instead than allowing any person to spend in anything, the SEC developed an approved capitalist standard.

In extremely basic terms, unregulated protections are thought to have higher dangers and higher rewards than controlled investment lorries. It is essential to keep in mind that SEC regulations for accredited investors are created to shield financiers. Uncontrolled protections can give extraordinary returns, yet they also have the prospective to produce losses. Without oversight from economic regulatory authorities, the SEC just can't review the threat and benefit of these investments, so they can not offer info to educate the ordinary financier.

The concept is that investors who earn sufficient revenue or have sufficient wide range are able to soak up the risk far better than investors with reduced earnings or much less wealth. As a certified investor, you are expected to complete your very own due persistance prior to adding any property to your financial investment profile. As long as you meet one of the following 4 requirements, you qualify as a certified capitalist: You have actually earned $200,000 or more in gross earnings as a specific, every year, for the previous two years.

Value High Yield Investments For Accredited Investors Near Me

You and your spouse have actually had a consolidated gross earnings of $300,000 or more, every year, for the previous two years. And you anticipate this level of earnings to continue. You have a total assets of $1 million or even more, leaving out the worth of your key house. This suggests that all your properties minus all your financial debts (leaving out the home you reside in) total over $1 million.

Or all equity proprietors in business certify as recognized financiers. Being an accredited financier opens doors to investment opportunities that you can't access otherwise. Once you're recognized, you have the alternative to invest in unregulated securities, that includes some superior financial investment opportunities in the property market. There is a vast range of property investing strategies available to financiers who do not presently fulfill the SEC's requirements for accreditation.

Professional Accredited Investor Opportunities

Becoming an approved investor is just an issue of confirming that you fulfill the SEC's requirements. To validate your earnings, you can provide documentation like: Earnings tax returns for the previous 2 years, Pay stubs for the past 2 years, or W2s for the past two years. To validate your total assets, you can give your account statements for all your possessions and liabilities, including: Savings and checking accounts, Investment accounts, Superior loans, And realty holdings.

You can have your attorney or CPA draft a confirmation letter, validating that they have actually examined your financials and that you satisfy the requirements for a recognized financier. However it may be much more affordable to use a service particularly developed to confirm certified investor standings, such as EarlyIQ or .

Dependable Accredited Investor Real Estate Deals

For instance, if you join the genuine estate financial investment firm, Gatsby Investment, your recognized investor application will be refined via VerifyInvestor.com at no charge to you. The terms angel financiers, innovative investors, and accredited investors are commonly used reciprocally, however there are refined differences. Angel investors offer venture capital for start-ups and local business in exchange for ownership equity in business.

Normally, any individual that is recognized is thought to be an advanced investor. People and company entities who preserve high revenues or large wealth are presumed to have practical knowledge of financing, certifying as advanced. real estate crowdfunding accredited investors. Yes, worldwide financiers can end up being accredited by American financial requirements. The income/net worth demands remain the same for international financiers.

Here are the ideal investment opportunities for certified financiers in actual estate.

Some crowdfunded actual estate investments don't call for certification, yet the tasks with the biggest potential rewards are generally booked for recognized financiers. The difference in between jobs that accept non-accredited capitalists and those that only accept accredited capitalists normally boils down to the minimum investment quantity. The SEC currently limits non-accredited investors, that earn less than $107,000 annually) to $2,200 (or 5% of your yearly income or net worth, whichever is less, if that amount is even more than $2,200) of investment funding annually.

Table of Contents

Latest Posts

Tax Lien Investment Bible

Tax Lien Investment

Tax Ease Lien Investments Llc

More

Latest Posts

Tax Lien Investment Bible

Tax Lien Investment

Tax Ease Lien Investments Llc